Have you ever come across the term “written off” in your CIBIL report and wondered what it means? Understanding the implications of a written-off account is crucial for managing your finances and maintaining a healthy credit score. In this comprehensive guide, we’ll delve into What is the meaning of “written off” in CIBIL reports, how it affects your creditworthiness, and steps you can take to address it.

What does “Written Off” mean?

When a lender deems an account uncollectible due to non-payment by the borrower for an extended period, they may write off the debt. However, this does not mean the debt is forgiven or erased. Instead, it signifies that the lender no longer expects to recover the outstanding balance and has closed the account.

Implications of a Written-Off Account

A written-off account has significant implications for your credit score and financial health. It reflects negatively on your credit report and indicates to future lenders that you have defaulted on your payments. This can make it challenging to qualify for loans or credit cards in the future and may result in higher interest rates or stricter terms.

How Does a Written-Off Account Affect Your Credit Score?

A written-off account can have a severe impact on your credit score, causing it to plummet significantly. The presence of a written-off account indicates to credit bureaus that you have failed to fulfil your financial obligations, leading to a lower credit score. This can make it difficult to access credit or obtain favourable terms on loans or credit cards.

Resolving a Written-Off Account

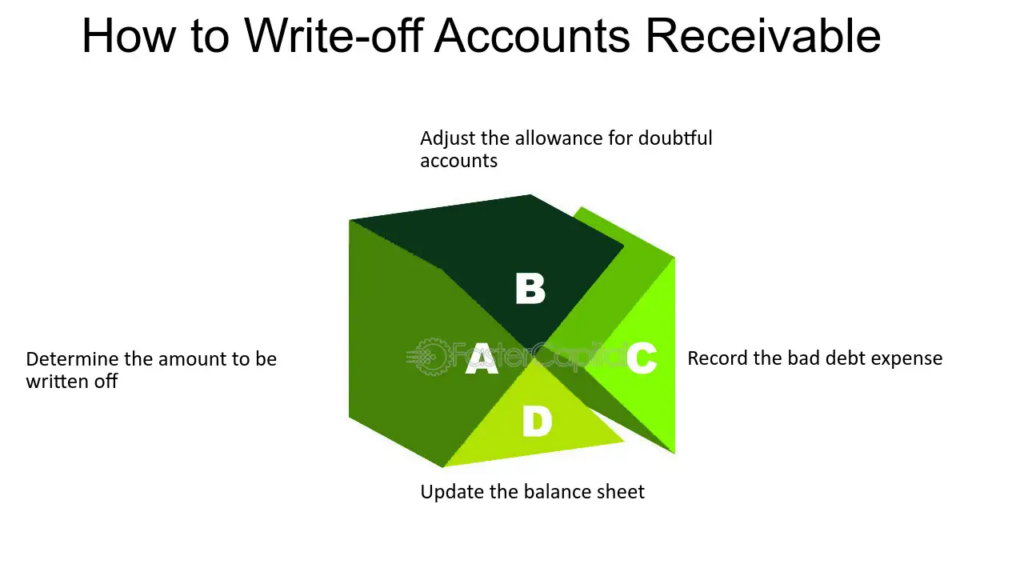

While a written-off account can have adverse effects on your creditworthiness, it is not the end of the road. There are steps you can take to address and resolve a written-off account:

Review Your Credit Report

Start by obtaining a copy of your credit report from CIBIL or other credit bureaus. Review the report carefully to identify any written-off accounts and verify the accuracy of the information provided.

Contact the Lender

Reach out to the lender associated with the written-off account to understand the status of the debt and explore options for repayment or settlement. Negotiate with the lender to reach a mutually acceptable solution that allows you to resolve the debt.

Settle the Debt

If possible, consider negotiating a settlement with the lender to pay off the written-off debt. This may involve agreeing to a lump sum payment or a structured repayment plan. Ensure that you obtain written confirmation of the settlement terms from the lender.

Rebuild Your Credit

Once you have resolved the written-off account, focus on rebuilding your credit by making timely payments on all your financial obligations. Establishing a positive payment history and managing your credit responsibly can help improve your credit score over time.

Deciphering “Written Off” in CIBIL: Strategies for Financial Recovery

Understanding the meaning of “written off” in CIBIL reports is essential for managing your finances and maintaining a healthy credit score. While a written-off account can have negative implications for your creditworthiness, it is possible to address and resolve the issue with proactive steps. By reviewing your credit report, contacting the lender, and negotiating a settlement, you can take control of your financial situation and work towards rebuilding your credit.

What is the Meaning of Written Off in CIBIL FAQ’s

1. What does written off mean?

When a lender deems an account uncollectible due to non-payment by the borrower for an extended period, they may write off the debt. However, this does not mean the debt is forgiven or erased. Instead, it signifies that the lender no longer expects to recover the outstanding balance and has closed the account.

2. How does a written-off account affect my credit score?

A written-off account can have a severe impact on your credit score, causing it to plummet significantly. The presence of a written-off account indicates to credit bureaus that you have failed to fulfil your financial obligations, leading to a lower credit score. This can make it difficult to access credit or obtain favourable terms on loans or credit cards.

3. What steps can I take to resolve a written-off account?

- To resolve a written-off account, you can review your credit report to identify any written-off accounts and verify the accuracy of the information provided.

- Contact the lender associated with the written-off account to understand the status of the debt and explore options for repayment or settlement.

- Negotiate with the lender to reach a mutually acceptable solution that allows you to resolve the debt.

- Make timely payments on all your financial obligations to rebuild your credit over time.

Leave A Comment